|

Ellen Cardona

Appendixes A, B, C : The Hazard Circular & Other Documents

The Hazard Circular:

Slavery is likely to be abolished by the war power and chattel slavery abolished. This I and my European friends are in favor of, for slavery is but the owning of labor and carries with it the care of the laborers while the European plan, led on by England, is that capital shall control labor by controlling wages.

Appendix B

The following is a letter dated June 25, 1863 to the banking firm of Ikleheimer, Morton and Vandergould from the Rothchilds�s firm, located in London:

A Mr. John Sherman has written us from a town in Ohio, U. S. A., as to the profits that may be made in the National Banking business under a recent act of your Congress, a copy of which act accompanied his letter. Apparently this act has been drawn upon the plan formulated here last summer by the British Bankers� Association and by that Association recommended to our American friends as one that if enacted into law, would prove highly profitable to the banking fraternity throughout the world.

Mr. Sherman declares that there has never before been such an opportunity for capitalists to accumulate money, as that presented by this act and that the old plan, of State Banks is so unpopular, that the new scheme will, be mere contrast, be most favorably regarded, notwithstanding the fact that it gives the National Banks an almost absolute control of the National finances. �The few who can understand the system,� he says, �will either be so interested in its profits, or so dependent on its favors, that there will be no opposition from that class, while on the other hand, the great body of the people, mentally incapable of comprehending the tremendous advantages that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.�

Please advise us fully as to this matter, and also, state whether or not you will be of assistance to us, if we conclude to establish a National Bank in the City of New York. If you are acquainted with Mr. Sherman (he appears to have introduced the National Banking act), we will be glad to know something of him. If we avail ourselves of the information he furnished, we will of course make due compensation.

Awaiting your reply, we are, etc.[2]

Appendix C

The following is a printed circular regarding the organization of a national bank. The circular was enclosed in the reply dated July 5, 1863 from Ikleheimer, Morton and Vandergould to the Rothschilds:

We have had so many inquiries of late as to the method of organizing national banks under the recent act of congress, and as to the profits that may reasonably be expected from such an investment, that we have thought it best to issue this brief circular as an answer to all questions of our friends and clients:

1. Any number of persons, not less than five, may organize a National Banking Corporation.

2. Except in cities having 6,000 inhabitants or less, a national bank can not have less than $1,000,000 capital.

3. They are private corporations organized for private gain, and select their own officers and employees.

4. They are not subject to the control of the state laws, except as congress may from time to time provide.

5. They can receive deposits and loan the same for their own benefit.

6. They can buy and sell bonds, and discount paper and do a general banking business.

7. To start a national bank on the scale of $1,000,000 will require the purchase of that amount (par value) of U. S. Government bonds.

8. U. S. Government bonds can now be purchased at 50 per cent discount, so that a bank of $1,000,000 capital can be started at this time with only $500,000.

9. These bonds must be deposited with the U. S. Treasury at Washington, as security for the national bank currency, that on the making of the deposit will be furnished by the government to the bank.

10. The U. S. Government will pay 6 per cent interest on the bonds, in gold, the interest being paid semi-annually. It will be seen that at the present price of the bonds, the interest paid by the government, will of itself amount to 12 per cent in gold, on all the money invested.

11. The U. S. Government, under the provisions of the national banking act, on having the bonds aforesaid deposited with its treasurer, will on the strength of such security, furnish national currency to the bank depositing the bonds, to the amount of 90 per cent of the face of the bonds, at any annual interest of only ONE per cent per annum. Thus deposit of $1,000,000 will secure the issue of $900,000 in currency.

12. This currency is printed by the U. S. Government in a form so like greenback money, that many people do not detect the difference, although the currency is a but a promise of the bank to pay�that is, it is the bank�s demand note, and must be signed by the bank�s president before it can be used.

13. The demand for money is so great that this currency can be readily loaned to the people across the counter of the bank at a discount at the rate of 10 per cent at 30 to 60 days� time, making about 12 per cent interest on the currency.

14. The interest on the bonds, plus the interest on the currency which the bonds secure, plus the incidentals of the business ought to make the gross earnings of the bank amount to from 28 to 33 1/3 per cent. The amount of dividends that may be declared will depend largely upon the salaries the officers of the bank vote themselves, and the character and rental charges of the premises occupied by the bank as a place of business. In case it is thought best that the showing of profits should not appear too large, the now common plan of having the directors buy the bank buildings and then raising the rent and the salaries of the president and cashier may be adopted.

15. National banks are privileged to either increase or contract their circulation at will and, of course, can grant or withhold loans as they may see fit. As the banks have a national organization, and can easily act together in withholding loans or extending time, it follows that they can by united action in refusing to make loans, cause a stringency in the money market and in a single week or even a single day cause a decline in all the products of the country. The tremendous possibilities of speculation involved in this control of the money of a country like the United States, will be at once understood by all bankers.

16. National banks pay no taxes on their bonds, nor on their capital, nor on their deposits. This exemption from taxation is based on the theory that the capital of these banks is invested in U. S. securities, and is a remarkable permission of the law.

17. The secretary may deposit the public money with any bank at will, and to any amount. In the suit of Mr. Branch against the United States, reported in the 12th volume of the U. S. Court of Claims Reports, at page 287, it was decided that such �Government deposits are rightfully mingled with the other funds of the bank, and are loaned or otherwise employed in the ordinary business of the bank, and the bank becomes the debtor of the United States precisely as it does to other depositors.

Requesting that you will regard this circular as strictly confidential, and soliciting any favors in our line that you may have to extend, we are, etc. [3]

FOOTNOTES

1.

Willis Overholser, A Short Review and Analysis of the History of Money in the United States (Libertyville: Progress Publishing Concern, 1936), 45. This cite also appears in the following: Charles Coughlin, Money! Questions and Answers (Royal Oak: The National Union for Social Justice, 1936), 175.

2.

Willis Overholser, A Short Review and Analysis of the History of Money in the United States (Libertyville: Progress Publishing Concern, 1936), 46. This cite also appears in the following: Charles Coughlin, Money! Questions and Answers (Royal Oak: The National Union for Social Justice, 1936), 170-171.

3.

Willis Overholser, A Short Review and Analysis of the History of Money in the United States (Libertyville: Progress Publishing Concern, 1936), 47-48. This cite also appears in the following: Charles Coughlin, Money! Questions and Answers (Royal Oak: The National Union for Social Justice, 1936), 173-175.

see also:

[FlashPoint 10]

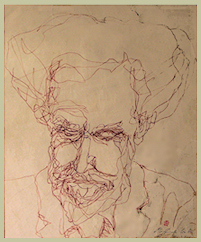

Pound in Italy, 1924-1939: The Progression of Pound's Anti-Semitism

WORLD WAR II AND POUND, 1940-1945: THE ANTI-SEMITE REVEALED

Pound's Anti-Semitism at St. Elizabeths: 1945-1958

|